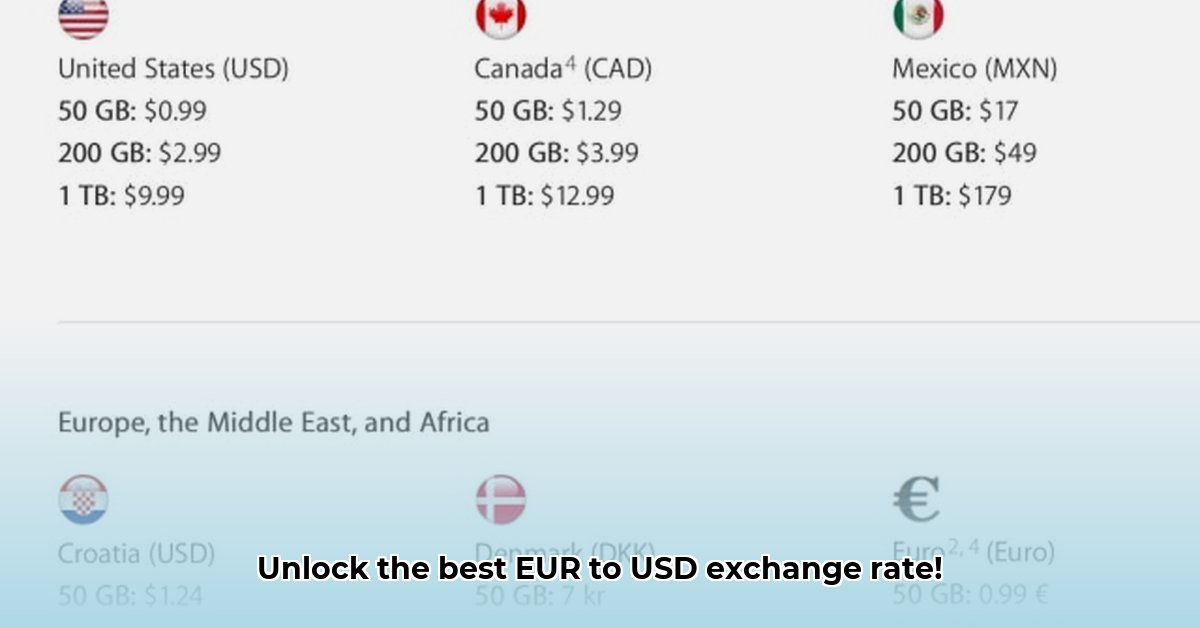

So, you need to convert 9.99 Euros to US Dollars? While seemingly straightforward, currency exchange involves nuances that can significantly impact your final amount. This guide equips you with the knowledge and strategies to secure the best possible exchange rate and avoid hidden fees. For more complex conversions, like larger sums of Chinese Yuan, see this helpful currency converter.

Understanding Exchange Rates: Beyond the Mid-Market Rate

The exchange rate you see online—often the "mid-market rate"—represents the theoretical average between the Euro and the Dollar. However, the actual rate you receive will differ due to fees added by banks and money transfer services. These fees, commonly called the "spread" or "margin," represent the difference between the buying and selling price of currencies. Additionally, many providers impose transaction fees or commissions. These seemingly small additions can accumulate, especially when dealing with multiple transactions or larger sums. The EUR/USD exchange rate is also dynamic, fluctuating constantly based on various global economic factors. Understanding these elements is crucial for getting the best deal.

Finding the Best Exchange Rate: A Comparative Approach

Don't settle for the first exchange rate you encounter. Instead, adopt a multi-pronged approach to ensure you're getting the best possible deal. A seemingly favorable exchange rate can be negated by hefty hidden fees.

Step 1: Multiple Provider Comparison: Check exchange rates from various providers: banks, online money transfer services (like Wise or OFX), and credit card companies. Note that online services often offer more competitive rates than traditional banks.

Step 2: Fee Transparency: Thoroughly analyze all associated fees. Look beyond the headline exchange rate to identify transfer fees, commissions, or any hidden charges. Some providers clearly display all fees upfront, while others might bury them in the fine print.

Step 3: Terms and Conditions Review: Meticulously review all terms and conditions before proceeding with the transfer. Understand the exact fees, timing of deductions, and any potential penalties. This diligent review will ensure no unpleasant surprises.

Step 4: Rate Alert Setup (Optional): Some providers offer rate alerts. Set up an alert to be notified when the exchange rate reaches a target level. This allows you to time your transfer strategically, optimizing your return, but remember that short-term rate predictions are unpredictable.

Choosing a Safe and Reputable Provider: Prioritizing Security

Selecting a reliable provider is crucial to protect your funds and personal information. Avoid unfamiliar or poorly-reviewed services.

- Reputation Check: Research potential providers using independent review sites and check their online reputation. A long history of positive user experiences is a strong indicator of reliability.

- Licensing and Regulation: Verify that they are properly licensed and regulated by relevant financial authorities. This provides an extra layer of protection against fraud or scams.

- Security Measures: Ensure the provider utilizes strong security protocols such as encryption and secure payment gateways to safeguard your financial and personal data.

Minimizing Costs and Risks: Strategic Tips for Currency Conversion

Several strategies can help you minimize costs and risks associated with currency exchange.

- Credit Card Usage: If your credit card offers no foreign transaction fees, this is often the most convenient and potentially cost-effective method. Be sure to pay the balance in full immediately to avoid interest charges.

- ATM Withdrawal Planning: When withdrawing cash from ATMs, aim for fewer, larger withdrawals to minimize per-transaction fees. However, prioritize your personal safety and avoid carrying large sums of cash.

- Local Currency Usage: Whenever feasible, using local currency directly helps to bypass conversion fees, though you may incur an initial conversion at the outset of your trip.

Long-Term Strategies: Handling Recurring Currency Exchanges

For regular Euro to Dollar conversions, consider these long-term strategies.

- Hedging: For larger sums, consider hedging to mitigate the risk of unfavorable exchange rate movements. However, hedging strategies are more complex and require a deeper understanding of financial markets.

- Currency Diversification: Distributing your investments across various currencies can help reduce the overall risk associated with exchange rate fluctuations.

Actionable Steps: Converting Your 9.99 Euros

- Research & Compare: Investigate exchange rates and fees offered by multiple providers.

- Analyze Fees: Scrutinize all fees (transfer, commission, hidden charges) to choose the most cost-effective option.

- Select a Provider: Select a reputable, secure, and licensed provider with positive reviews.

- Complete Transfer: Carefully initiate the transfer, verifying all details to prevent errors.

Remember, even with a small amount like 9.99 Euros, careful planning and informed decision-making can yield significant savings. Take the time to research, compare, and choose wisely!